What are dark patterns in fintech apps, and how can you spot them?

Fintech applications have become part of our everyday lives—whether we’re managing our bank accounts, taking out loans, investing, or buying insurance. We expect them to be transparent, easy to use, and ethical. But the truth is, not every app plays fair. Some use manipulative design tricks called “dark patterns” to push us into actions we might not really want to take.

In this article, we’ll explore what dark patterns are, how they work, the most common ways they show up in financial apps, why they can be harmful, and—most importantly—how you can spot and avoid them. We’ll also look at how we can encourage developers to design apps that are more transparent and user-friendly.

What does “dark pattern” mean?

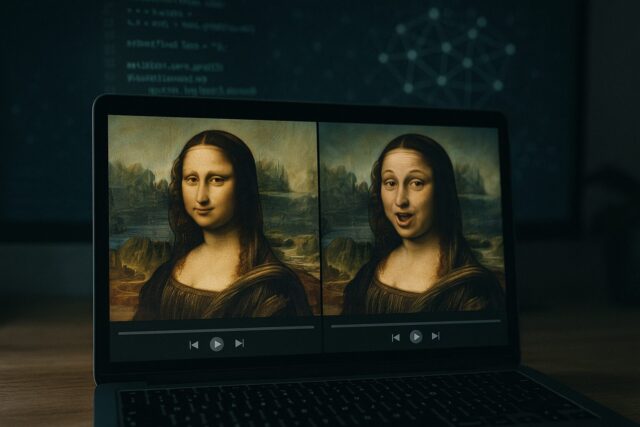

A dark pattern is a user interface (UI/UX) design tactic that intentionally misleads or manipulates you into making choices you didn’t plan to make—like subscribing to a service, sharing personal data, or struggling to cancel an option.

These aren’t mistakes or bad design. They’re deliberate choices aimed at boosting conversions or revenue, even if it comes at the expense of your trust or experience. The term first appeared in the early 2010s among UX professionals, and since then, dark patterns have become common in online shopping and financial services.

Common dark patterns in fintech apps

Hidden fees – You don’t see the real cost until it’s too late. For example, a loan calculator might only show the APR, leaving out extra administrative fees.

Misleading buttons – The “Skip” button is hard to find or greyed out, while the “Accept” button is big and bright.

Forced extras – You can’t complete registration or a transaction without signing up for extra services like insurance or newsletters.

Difficult cancellations – Canceling a subscription takes multiple steps and throws in obstacles like “Are you sure you want to leave?” or hiding the cancel button.

Fake urgency – Countdown timers or “Only 2 offers left!” pop-ups that aren’t real, but push you into making quick decisions.

Automatic reactivation – You pause a subscription, only to find it restarted under the excuse of “system maintenance.”

Social pressure tricks – Messages like “John from London just bought this plan” to make you feel like everyone else is doing it.

Real-world examples

Some money transfer apps automatically set the more expensive “express” option as the default.

Loan apps show the lowest monthly payment but hide the total repayment amount.

Budget apps start charging an annual fee after a “free trial” without warning.

Insurance calculators require personal data but only give results through paid consultations.

Why they’re dangerous

Dark patterns in finance can cost you money through hidden charges, unwanted subscriptions, or accidental transactions. They erode trust in fintech services, push you into decisions based on incomplete information, and may even cross legal lines—EU rules now ban many deceptive designs. They also hurt innovation: if trust drops, people are less willing to try new digital finance tools.

How to protect yourself

Always read the fine print, especially with subscriptions or loans.

If something looks too good to be true, it probably is.

Check reviews and forums to see if others have reported shady behaviour.

Try the app with a small amount before making a big transaction.

Use bank alerts to flag suspicious charges.

If you notice something off, contact consumer protection or a digital rights group.

If you’ve been caught in a dark pattern

Contact customer service immediately and ask for a detailed statement.

File a complaint with the financial regulator.

Leave a review in the app store to warn others.

If the loss is serious, get legal advice from a digital law expert.

How to push for better design

Give feedback and good ratings to apps that are transparent and fair.

Support groups lobbying for ethical fintech design.

Help friends and family recognise online manipulation tactics.

Promote open-source projects, public update logs, and community-driven apps.

Fintech apps can be incredibly useful, but not all of them have your best interests at heart. Dark patterns are designed to influence your decisions—often in ways that benefit the company, not you. Staying informed, questioning what you see, and sharing your experiences can help build a safer, fairer, and more transparent digital financial world.

Image(s) used in this article are either AI-generated or sourced from royalty-free platforms like Pixabay or Pexels.