The spread of contactless bank cards (NFC-enabled cards) has revolutionized payments, making shopping faster, more convenient, and in many cases more hygienic. However, alongside this development, stories have emerged claiming that fraudsters can deduct money from our cards—even through our pockets—by bringing a mobile terminal close to us. But how real is this threat in 2025? In this article, we’ll take a detailed look at how the technology works, the potential misuse scenarios, available protective measures, and practical tips for safe card usage.

How contactless bank cards work

NFC (Near Field Communication) technology enables a bank card to be read and a transaction initiated from just a few centimeters away, typically at POS terminals or other contactless payment devices.

-

Range: usually 2–4 cm

-

Data transmission: the chip communicates with the reader via short-range radio waves

-

PIN requirement: in Hungary, a PIN code is required for transactions above 5,000 HUF

The theoretical possibility of fraud

Possible scenario:

A fraudster with a mobile terminal (for example, a smartphone running a SoftPOS application) attempts to “read” our card while it is in our pocket or bag.

Technical obstacles:

-

NFC only works at a very close range (2–4 cm)

-

Most banks require a PIN for amounts above 5,000 HUF

-

In most cases, it’s impossible to complete a transaction if the card is inside a wallet, back pocket, or bag—the materials can physically block the signal

Real risk

In practice, this type of fraud is extremely rare but not entirely impossible. The most likely targets are situations where the card is poorly stored, and there are large crowds (e.g., public transport, festivals).

Protection methods

1. rfid-blocking wallets and sleeves

Made from special materials that block NFC signals, preventing the card from being read.

-

Price: 700 – 6,000 HUF

-

Available at: eMAG, Trendhim.hu, Tintasziget

2. use of virtual cards

Several banks offer digital-only cards that can be activated only from a mobile app, reducing risk by eliminating the physical card.

3. mobile payments

Apple Pay, Google Pay, and similar apps can be more secure because they use tokenized data and require biometric authentication for each transaction.

4. setting bank limits and notifications

-

Set a low daily limit for contactless transactions

-

Enable push notifications for all card usage

What to do in case of a suspicious transaction

-

Immediately block the card

All banks offer quick blocking options via phone or app. -

Notify your bank

Initiate a chargeback request and file a complaint—the bank will start an investigation. -

File a police report

If fraud is suspected, it’s worth reporting it to the police.

Frequently asked questions

1. Can a fraudster make a transaction with the card in my pocket?

Only if they get within a few centimeters and the card is not shielded. In practice, this is extremely difficult.

2. Do banks have protective systems in place?

Yes, banks automatically monitor for suspicious patterns and may request verification or block the card.

3. Is it worth buying an RFID blocker?

Yes, especially if you often carry your card in crowded places or open bags.

While unauthorized transactions via a mobile card terminal are theoretically possible, they are extremely rare in practice due to technological limitations and security measures. Conscious user behavior, NFC blocking, enabling notifications, and favoring mobile payments all help ensure your money remains safe—even in the most crowded environments.

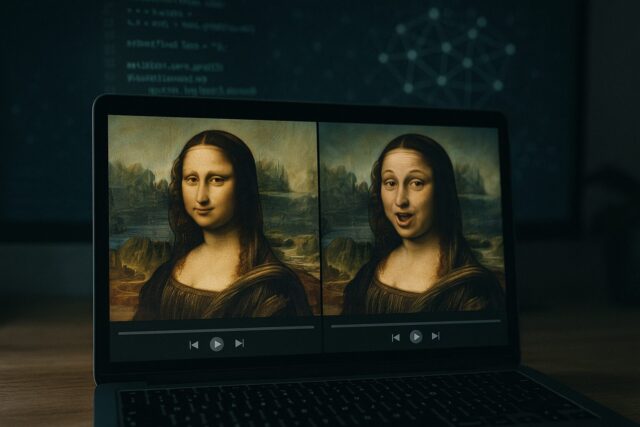

Image(s) used in this article are either AI-generated or sourced from royalty-free platforms like Pixabay or Pexels.

Did you enjoy this article? Buy me a coffee!