As digitalization accelerates, cashless payments have surged dramatically in Hungary — and worldwide. Paying by bank card, smart device, or online is undeniably convenient, but concerns about security are growing. In 2025, threats go far beyond classic card fraud. Phishing scams, mobile-based attacks, and even AI-generated fake transactions are now part of the landscape.

This guide explores the latest technologies protecting card payments, the most common risks you may face, and practical tips to keep your transactions safe.

The key new technologies in 2025

1. Biometric authentication

Bank cards and mobile payment apps now routinely use fingerprints, facial recognition, or even voice ID to verify transactions. Biometrics significantly reduce the chance of fraud, especially in online shopping.

2. Dynamic CVV codes

Some next-generation cards no longer have a fixed security code (CVV). Instead, the CVV changes periodically, often generated by a secure app — making stolen card details useless to criminals.

3. Tokenization and virtual cards

Payment systems like Apple Pay and Google Pay replace real card numbers with unique “tokens,” hiding your actual data from merchants. Banks also offer single-use or temporary virtual cards for safer online purchases.

4. AI-powered transaction monitoring

Advanced algorithms in banking systems can now detect suspicious patterns in real time, automatically blocking risky transactions or sending instant alerts.

5. NFC and QR code payments

Contactless and QR-based payment methods are fast and convenient — but require proper setup and attention to security settings.

The most common threats in 2025

1. Phishing attacks

Fraudulent emails, text messages, or fake banking websites remain the most common scam methods. Messages look increasingly professional, so avoiding suspicious links and attachments is vital.

2. Mobile-based fraud

Malicious apps, unauthorized installations, and using public Wi-Fi can give criminals access to your banking data.

3. Card cloning (skimming)

While less common than before, fraudsters can still capture your card data via compromised ATMs or public payment terminals.

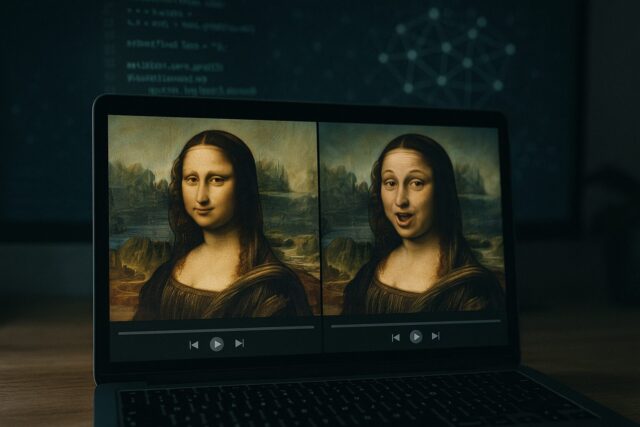

4. AI-driven fraud

Emerging attacks use deepfake audio or video to bypass identity verification. User awareness and caution are crucial defenses here.

How to protect yourself

-

Enable transaction alerts — Set up SMS or push notifications for every payment.

-

Use virtual cards for online shopping — Many banks offer single-use virtual card numbers.

-

Never share your banking details — A legitimate bank will never ask for your credentials via email, phone, or social media.

-

Keep your apps and OS updated — Security patches close vulnerabilities before they can be exploited.

-

Monitor your account regularly — Report and block your card immediately if you notice suspicious activity.

Choosing the right bank for security

When selecting a bank, consider:

-

Do they offer biometric authentication?

-

Is there automated fraud detection?

-

Is customer support available 24/7?

-

Do they support digital wallets?

-

How quickly can you freeze or reactivate a card?

Card payments in 2025 are safer than ever — but only if users remain vigilant. Advanced authentication, virtual cards, and AI-based fraud prevention significantly lower the risk, yet scammers are becoming just as sophisticated. Staying alert, keeping your systems updated, and using the latest security tools are essential steps for every cardholder.

Image(s) used in this article are either AI-generated or sourced from royalty-free platforms like Pixabay or Pexels.

Did you enjoy this article? Buy me a coffee!